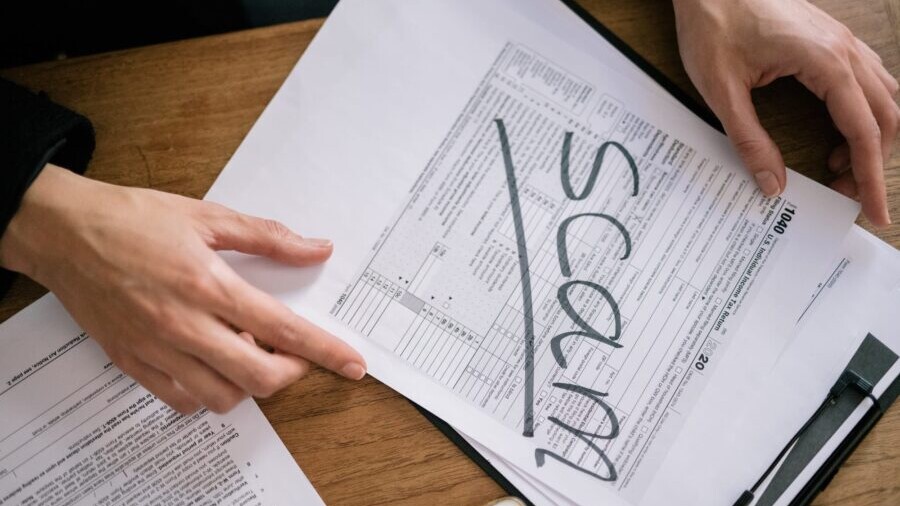

Without anti-fraud controls, businesses are left vulnerable to many types of fraud. Anti-fraud controls can look different for every business as the threats one company is facing may not be the same as another. The size and industry of the organisation also affect the prevention measures in place. Fraud does not discriminate; it can happen to any business at any time. In 2022, a survey by PwC revealed that 51% of the companies that participated had experienced fraud in the last two years. This number is only expected to increase as time passes.

Types of fraud

To develop effective anti-fraud controls, businesses need to be aware of what fraud may look like. Fraud is evolving, individuals are finding new ways to commit crimes and outdated education may mean that fraud goes undetected for longer. The most common types of fraud are:

Asset misappropriation

Asset misappropriation refers to the illegal or unethical use of a company’s resources by an employee or an individual in a position of trust for personal gain. This type of fraud is costly and difficult to detect. Examples of asset misappropriation include:

- Embezzlement

- Payroll schemes

- Skimming

- Expense reimbursement schemes

The types of anti-fraud controls will vary for asset misappropriation as it can take many forms.

Bribery and corruption

Bribery and corruption are both illegal and unethical practices. Bribery involves providing or accepting something of value in exchange for a perceived advantage or benefit. It may include cash, favours or promises with the intention of influencing the behaviour of the recipient, typically in a way that is beneficial to the giver. Corruption, on the other hand, is a more broad concept that refers to the abuse of power or position for personal gain or manipulation. People in positions of power may not even promise anything, just demand it or hide information and evidence on their own.

Both bribery and corruption can have negative impacts on a business, including reduced public trust, distorted competition and lower sales. This is why strong anti-fraud controls are necessary.

One of the biggest corruption scandals in Europe is the Siemens bribery case in Greece that saw funds of 70€ million being paid by Siemens to a telecom company. The case gained a lot of media attention and is still hurting the German company to this day. A lot of the individuals involved in the case had to pay fines while others were sentenced to jail.

Financial statement fraud

Financial statement fraud occurs when a business falsifies or misrepresents financial information in their statementions on purpose. It can include overstatement or understatement of assets or liabilities, inflation or deflation of revenue or expenses or misrepresentation of financial performance.

Individuals who commit financial statement fraud can include company executives, accountants or other third parties who have access to financial records. Motives for financial statement fraud can vary, but often include a desire to boost the company’s stock price, secure loans or other financing or conceal financial difficulties or mismanagement.

Depending on who the audience is, financial statements can look different for each stakeholder. So while an investor may receive a positive picture of the company’s finances, the government may receive a negative one.

Financial statement fraud can affect investors, employees and the company itself. For example, if a company’s financial statements are found to be fake or modified, investors may lose trust in the company and may not invest in it in the future. Employees could lose their jobs if the company is forced to downsize or go into bankruptcy as a result of the fraud. Without effective anti-fraud controls implemented, the future of the business can be uncertain or at risk.

Identity theft

Identity theft occurs when someone obtains and uses another person’s information for fraudulent purposes, such as accessing bank accounts, opening credit cards or obtaining loans. Sometimes it can be hard to detect until a lot of damage is already done as there is no other way for an individual to know that their identity has been stolen.

The methods people use to commit fraud are constantly changing, making it hard to stay up to date and challenging for businesses to protect against this type of fraud. For example, cyber-attacks using malware, phishing and other techniques can trick an employee and gain access to sensitive information. Employees within a company may also steal the identity of another and authorise payments and make decisions on their behalf.

Businesses should ensure that their employees take measures to protect their personal information during and outside work hours. This will also protect customer information and will prevent legal and financial consequences.

Anti-fraud controls can assist greatly in minimising negative consequences or preventing fraud in the first place.

Anti-fraud controls

Since there are many types of fraud, more than already discussed, it is necessary to implement anti-fraud controls that address as many of them as possible. Anti-fraud controls could include:

Whistle-blowing

The first option when it comes to anti-fraud controls is whistle-blowing as it can be quite effective. A whistle-blowing reporting system provides employees with a safe and confidential channel to report fraudulent activities within an organisation. This type of system is highly encouraged as employees may feel uncomfortable with reporting fraud face to face or with their identity known. It allows them to report fraud without fear of retaliation from their employer or colleagues.

A whistle-blowing line creates a culture of transparency and accountability within a company. Fraudulent activity thrives in an environment where employees feel like they are unable to report unethical behaviour. A whistle-blowing line sends a clear message to employees that the business takes fraudulent activity seriously and is committed to dealing with it efficiently and responsibly. This helps to create a positive work culture that is focused on integrity and honesty.

Knowing that there is a system in place to report fraudulent activity can increase the risk of being caught. This means that individuals who may have previously considered engaging in fraudulent activity may reconsider their actions, knowing that they are likely to be caught and consequences will follow.

Segregation of tasks

Segregation of tasks involves dividing responsibilities amongst different individuals within a department. This is because the segregation of duties ensures an individual does not have complete control or access to critical tasks within the organisation, which reduces the opportunity for fraud.

For instance, in an accounting department, the segregation of tasks could involve assigning payments to more than one team member while other employees are responsible for recording transactions. This not only reduces the chances of fraud taking place, but also reduces the chances of fraud going undetected for a long amount of time.

Segregation of duties is a great example of anti-fraud controls as it helps in establishing a system where important tasks are double or triple-checked by different people. This way, if one individual fails or is tempted to engage in fraudulent behaviour, the other person can detect and report it.

Regular audits

Regular audits examine financial records, operational systems and procedures and internal controls to ensure that financial reporting is accurate and reliable.

Auditors review financial documents, including income statements, balance sheets and cash flow statements to detect any discrepancies or falsifications in financial transactions. This includes monitoring vendor payments, employee reimbursements and cash transactions to prevent embezzlement or misappropriation of funds as well as financial statement fraud.

Audits also examine operational systems and procedures. This helps identify any inefficiencies or irregularities that can lead to fraudulent activities. For instance, auditors may examine inventory management practices to prevent employee theft or evaluate procurement procedures to prevent kickbacks or bribery.

Regular audits assess the strengths and weaknesses of an organisation’s anti-fraud controls. This includes reviewing organisational policies and procedures to ensure they are effective and up to date, as well as evaluating the implementation of procedures to ensure that they are followed consistently.

Background checks on employees

Background checks on employees may be necessary to verify the information provided by job applicants is true. Background checks ensure that the candidate has no history of dishonest behaviour. The following are some of the ways in which background checks can prevent fraud:

- Verification of experience: This may include calling references and checking with past employers or colleagues to verify educational qualifications, work experience and past employment.

- Criminal record checks: A criminal background check can ensure that the candidate does not have a fraudulent history. If a person has committed fraud in the past, this information can be used to disqualify them from the hiring process.

- Financial checks: In some scenarios and depending on the role and industry, employers may also conduct financial checks as part of the background check process. This can involve checking a candidate’s credit score, which can help identify financial problems that could potentially lead to fraud. If a person has a history of financial difficulties, they may be more likely to commit fraud in the workplace. However, that is not always the case, as it is only a part of the fraud triangle and other factors need to exist as well.

This one is one of the hardest examples of anti-fraud controls to implement as it is difficult to know everything or screen every employee.

Educating employees

Among the anti-fraud controls and measures, this one is the most common! With extensive training, employees can learn to identify potential indicators of fraud and take appropriate actions to mitigate these risks. Training can make employees aware of the various forms of fraud that commonly occur within an organisation. They can understand the techniques used by criminals, such as phishing scams or fake invoices, and learn how to spot them. As a result, employees can be more aware and know when to take action.

There are many fraud awareness courses as well as speakers that the business can hire to educate employees. Regular training can have many benefits and inform stakeholders of what the latest trends are as scams are becoming more and more believable.

Please remember

Anti-fraud controls are necessary for deterring fraud. While they do not guarantee the elimination of the risks, anti-fraud controls ensure that the business increases its security against fraudulent activities.

If you are looking for ways to support your current anti-fraud controls, Polonious offers an efficient way to conduct fraud investigations and show employees that you take their reports seriously. Our online transactions workflow can help your team manage fraudulent transactions and save your fraud analysts a lot of time. Moreover, the fact that our system can integrate with numerous software can assist in viewing and linking all important information in one place. Do you want to learn more? Reach out!

Let's Get Started

Interested in learning more about how Polonious can help?

Get a free consultation or demo with one of our experts

Eleftheria Papadopoulou

Eleftheria has completed a Bachelor's of Business with a major in Marketing at the University of Technology Sydney. As part of her undergraduate studies she also obtained a Diploma in Languages with a major in Japanese. Following her graduation she has been working as a Marketing Coordinator and Content and Social Media Specialist.

Eleftheria is currently finishing her Master in Digital Marketing.