The fraud triangle is a model that explains why people commit fraud. In order to prevent or identify fraud, it is vital to understand the reason behind people committing it. Knowing the ‘why’ can help managers know the ’how’ to set up strategies to protect their company.

Criminologist Donald Ray Cressey developed the fraud triangle to describe what elements need to be satisfied for workplace fraud to occur. His hypothesis was “Trusted persons become trust violators when they conceive of themselves as having a financial problem which is non-sharable, are aware this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their own conduct in that situation verbalisations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users of the entrusted funds or property.

The 10-80-10 rule

Donald’s hypothesis is similar to the 10-80-10 rule. This usually applies to ethics and it assumes 10% of people are always ethical, 80% of people may act unethically depending on the situation and the rest 10% are people who are always unethical. In fraud, this rule means that 10% of employees will never commit fraud. However, the business needs to focus on the 80% who might commit fraud and the 10% who will definitely commit fraud once they get the opportunity to. The fraud triangle is constructed to understand these groups and their motives behind their actions.

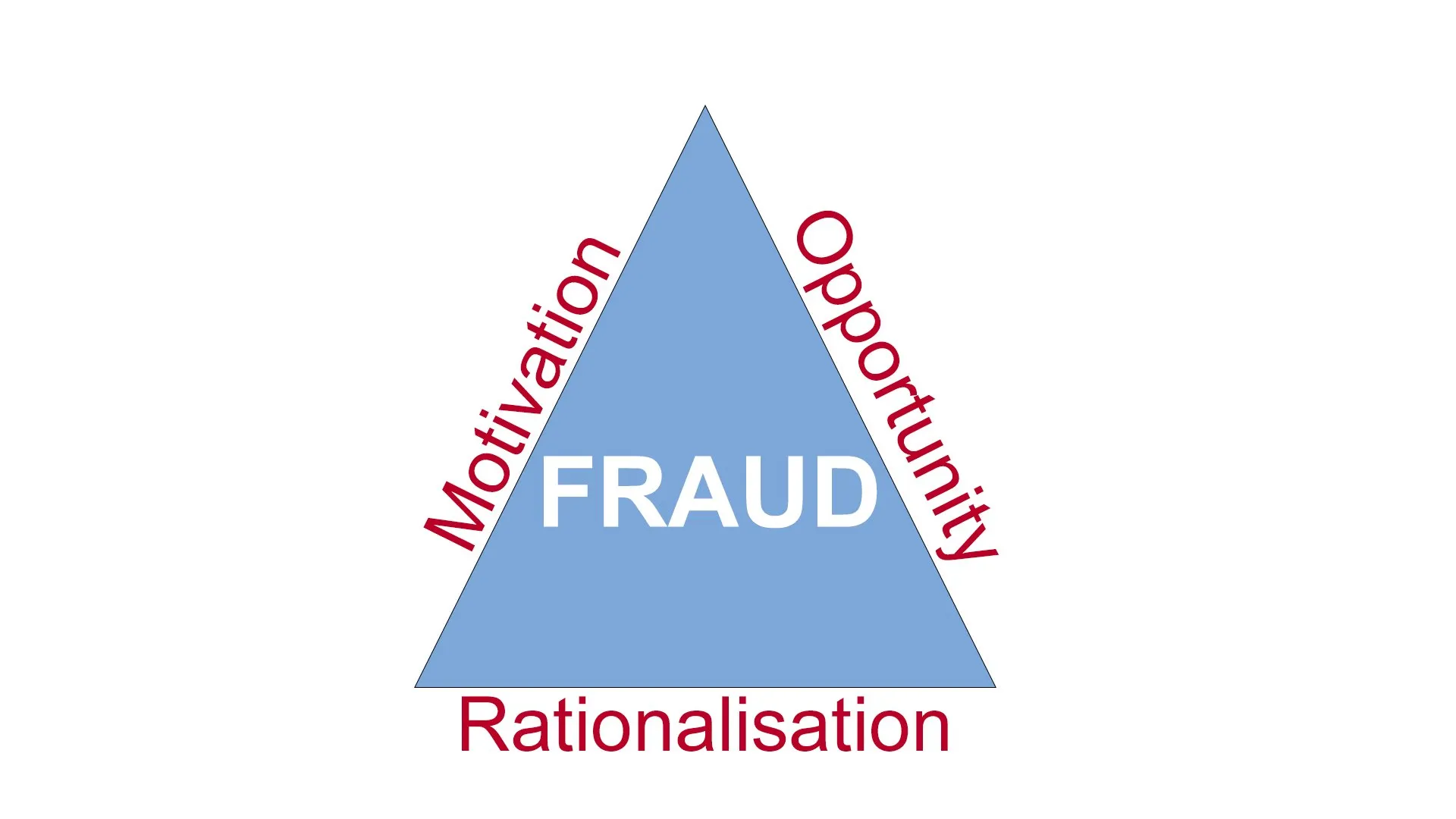

The three components of the fraud triangle

The fraud triangle theory asserts that three elements need to be present:

- Motivation

- Opportunity

- Rationalisation

Motivation

In the fraud triangle, motivation is also referred to as pressure. Each person lives a different life with different circumstances, while not everyone is unethical, the right situation can affect their moral compass. It could be that the person is in a bad financial state or is being pressured by higher-ups. Their job could be threatened or they might feel mistreated by the company. Individuals in the 80% usually try to solve their problems with rational and ethical solutions. Fraud is their least favoured approach. However, those in the 10% that are unethical are actively looking for a reason to commit fraud. They do not need a lot of motivation or pressure.

Businesses should try to understand the motivation behind employees’ fraudulent actions. If managers can create a supportive environment where staff are encouraged to ask for help when they need it, it is less likely for them to have a motive. They need to focus on giving them motivation not to act unethically.

Opportunity

The opportunity element describes the circumstances within the business that allow fraud to occur. There might be a weakness in internal controls or the policies and procedures in place might not be enforced. It could also be that the internal controls are not monitored to evaluate their effectiveness, therefore resulting in them not working properly. People will take advantage of an opportunity that will enable them to commit fraud unnoticed.

Even if a company has strong internal controls fraud is still possible. If a company is short-staffed and an employee has control over various responsibilities, this gives them a great opportunity to act unethically. If employees are in a position of power, they could also be tempted to benefit and work for their own interests.

This element of the fraud triangle allows businesses to understand the steps they can take to prevent fraud. Whether that is segregating of duties or implementing stronger internal controls. The possibility of fraud decreases when the opportunities available decrease.

Rationalisation

The third element of the fraud triangle is rationalisation. How do people reassure themselves that they are doing the right thing? For people to be sufficiently motivated to take advantage of the opportunity they need to justify their actions. The employee needs to convince themselves that the potential reward is worth risking the possibility of getting caught. They might tell themselves that they are not a criminal, they are just doing what is necessary to survive.

They might use other reasoning like the organisation will not miss the money being stolen or if everyone commits fraud in the industry so can they. If the organisation has weak internal controls they might rationalise it as fraud being unnoticed so they will not get caught. By rationalising their actions, staff will have a clean conscience and feel better about themselves.

The three elements combined form an environment where fraud is likely to happen. The fraud triangle gives businesses a better understanding of the thought process of a fraudster. It shows which areas of the business could be improved to prevent thoughts from turning into actions.

Benefits

The fraud triangle can help in designing and assessing internal controls. It highlights what strategies need to be implemented to protect the company from fraudulent activities.

Employers need to have policies that are enforced and explain what happens in the case of a violation. They will need to outline the legal and financial consequences of fraud. Training can reinforce the importance of policies and educate staff on fraud’s complications and how to report it. The business might need to communicate that bonuses depend on the company doing well. This could discourage employees from taking action that could jeopardise the business’s success.

As the fraud triangle shows the most common reasons people commit fraud, it can help the business determine what it could be doing wrong. It could be as simple as a lack of empathy. While businesses have the most direct control over ‘opportunities’ by strengthening organisational controls, they should not overlook the influence a business can have on ‘motivation’ by ensuring they have a good corporate culture. Employers need to be supportive of their employees and make them feel welcomed in the workplace. The policies in place need to be favourable to employees and created with their wellbeing in mind. If employees feel listened to and cared for they are less likely to act against the company.

Conclusion

The fraud triangle is a concept that is helpful for every business. It is important to understand that not all individuals will commit fraud but those who do always have a reason. By understanding the reason behind their actions, the business can implement strategies to discourage fraudulent activities from hurting the organisation. Businesses can then focus on the opportunities since the tightening internal controls are focused on mitigating internal risks.

The controls decrease the probability of fraud and the company is able to improve and be profitable. Risks to the company’s success should not be the sole motivation for employers to care for their employees. If employees feel that they are treated fairly and benefit from the company’s profits they are less likely to be a threat to the business.

Let's Get Started

Interested in learning more about how Polonious can help?

Get a free consultation or demo with one of our experts

Eleftheria Papadopoulou

Eleftheria has completed a Bachelor's of Business with a major in Marketing at the University of Technology Sydney. As part of her undergraduate studies she also obtained a Diploma in Languages with a major in Japanese. Following her graduation she has been working as a Marketing Coordinator and Content and Social Media Specialist.

Eleftheria is currently finishing her Master in Digital Marketing.